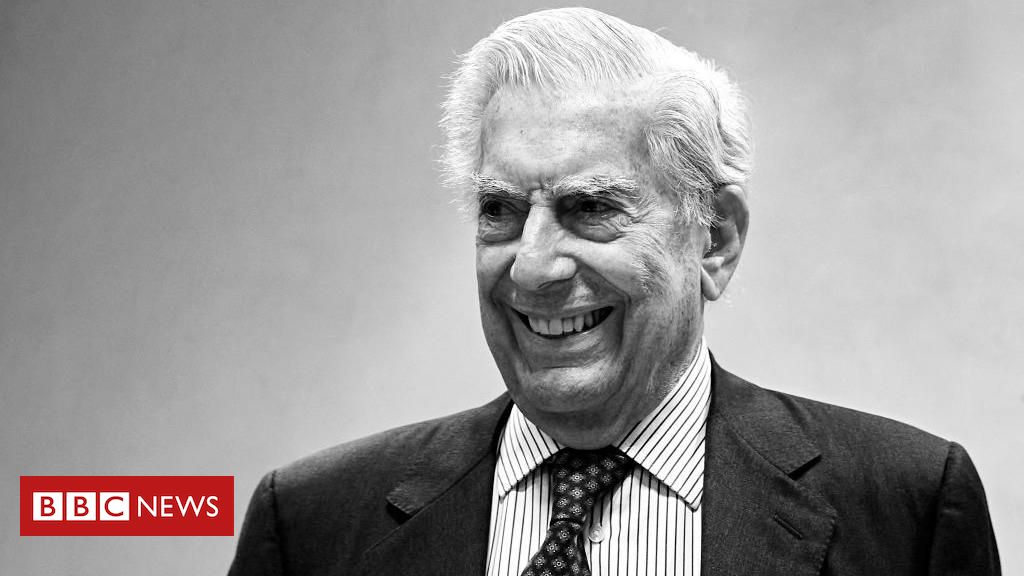

Crédito, Ilustração de Daniel Arce/BBC

E terminaria com um soco dado pelo autor peruano no então amigo colombiano.

Em janeiro de 1966, García Márquez (que ainda estava trabalhando em Cem Anos de Solidão) escreveu a primeira carta do México para Vargas Llosa, que estava em Paris.

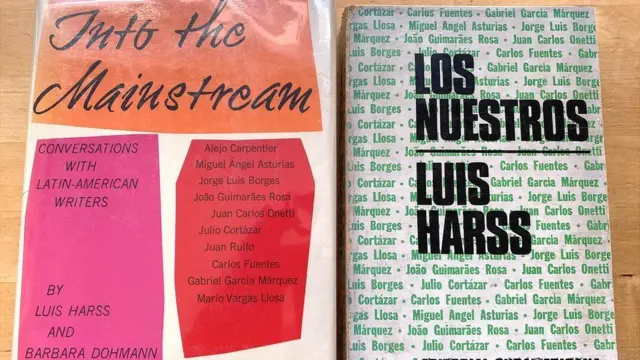

O endereço foi dado a ele por Luis Harss, o jornalista chileno-americano que, sem que soubesse, estava escrevendo o primeiro livro indispensável sobre o boom da literatura latino-americana (Los Nuestros, de 1966, publicado primeiro em inglês como Into the Mainstream).

“Caro Mario Vargas Llosa:

Por meio de Luis Harss, finalmente consegui seu endereço, que era impossível de encontrar no México, principalmente agora que Carlos Fuentes está perdido em sabe-se lá em qual manguezal da selva europeia.

O produtor de cinema Antonio Matouk está animado com a ideia de fazer “A cidade e os cachorros”, dirigido por Luis Alcoriza, no Peru (…).

Aqui, mal podemos esperar para ler A Casa Verde. Quando será publicado? Carmen Balcells, em sua visita ao México, ficou muito entusiasmada com os originais.

Mesmo que o projeto do filme não se concretize, fico feliz com a oportunidade que esta carta me dá de estabelecer contato.

Cordialmente, Gabriel García Márquez”. (1)

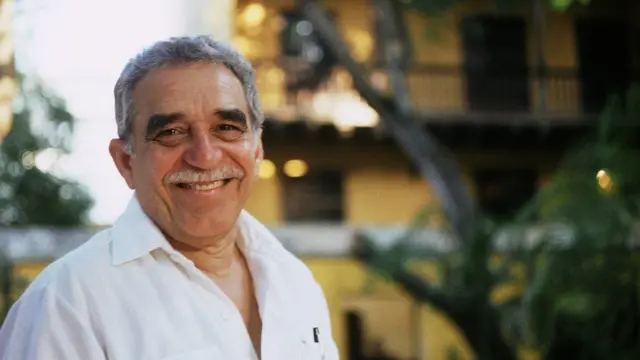

Após trocarem cartas por um ano e meio, período durante o qual chegaram a discutir a possibilidade de escrever um romance juntos, García Márquez e Vargas Llosa se encontraram pela primeira vez em 9 de agosto de 1967, no Aeroporto Maiquetía, em Caracas.

Gabo — agora o ilustre autor de Cem Anos de Solidão — chegou como convidado de honra para a entrega do Prêmio Rómulo Gallegos, que Vargas Llosa havia ganhado por A Casa Verde, e para participar de um congresso literário.

Crédito, BBC News Mundo

É assim que Vargas Llosa descreve este momento no livro García Márquez: História de um deicídio (sobre o qual falaremos mais adiante):

“Nos conhecemos na noite em que ele chegou ao aeroporto de Caracas; eu vinha de Londres, e ele, do México, e nossos aviões aterrissaram quase ao mesmo tempo. Antes tínhamos trocado algumas cartas, e até havíamos planejado escrever alguma vez um romance a quatro mãos — sobre a guerra tragicômica entre Colômbia e Peru em 1931 —, mas aquela foi a primeira vez que nos encontramos pessoalmente.

“Lembro-me muito bem dele naquela noite: desconcertado pelo terror recente do avião — do qual ele tem um medo mortal —, pouco à vontade entre os fotógrafos e jornalistas que o assediavam. Tornamo-nos amigos e ficamos juntos nas duas semanas do congresso.”

Era o início de uma grande amizade… que duraria menos de dez anos.

Conversa em Lima

Antes do encontro em Caracas, Vargas Llosa havia escrito uma resenha elogiosa sobre o romance recém-publicado de García Márquez, intitulada “Cem Anos de Solidão: o Amadis na América” (datada da “primavera de 1967”), com a qual deu início a uma relação fascinante com o romance e a obra do escritor colombiano, que culminaria quatro anos depois na publicação de História de um deicídio.

Esse deslumbramento ficaria evidente nas semanas seguintes, quando ambos os escritores visitaram Bogotá e Lima.

Na capital peruana, nos dias 5 e 7 de setembro, eles realizaram um “Diálogo sobre o romance na América Latina” que se tornaria lendário e circularia por décadas em fotocópias ou edições piratas, até ser finalmente publicado pela Alfaguara em abril de 2021.

Crédito, Getty Images

O que chamou a atenção tanto daqueles que presenciaram o diálogo (quanto dos leitores posteriores) é que, apesar de ser, naquela época, o romancista mais conhecido e estabelecido dos dois, Vargas Llosa agiu como uma espécie de entrevistador de García Márquez, que durante a conversa proferiu algumas de suas boutades, as frases espirituosas que o caracterizariam dali em diante (como a de que ele havia tentado escrever o romance aos 17 anos, ou que iria morar na Europa porque era mais barato).

Por acaso, foi nesta visita a Lima que nasceu o segundo filho de Vargas Llosa, que ele batizou de Gabriel Rodrigo Gonzalo em homenagem a García Márquez e seus dois filhos. Os padrinhos foram, é claro, Gabo e sua esposa, Mercedes Barcha.

Cada um voltaria então para sua respectiva casa. Mas não muito tempo depois, eles estariam morando com suas famílias em Barcelona, literalmente parede com parede.

Barcelona, capital do mundo

Ainda em Londres, Vargas Llosa continuaria a escrever seu próximo romance, Conversa no Catedral, ao mesmo tempo em que preparava um curso sobre García Márquez, que daria em Porto Rico em 1968, e que seria o embrião de seu longo ensaio sobre o autor colombiano.

Gabo já havia se mudado para Barcelona com Mercedes e os dois filhos (em novembro de 1967), incentivado por Carmen Balcells, a superagente literária que sempre procurou garantir que seus autores pudessem viver do que escreviam, sem distrações adicionais, algo nunca visto antes na América Latina.

Balcells fez a mesma oferta a Vargas Llosa, que em 1970 se mudou com a prima e esposa, Patricia Llosa, e os dois filhos para a capital catalã. Lá, em 1974, nasceria sua filha Morgana.

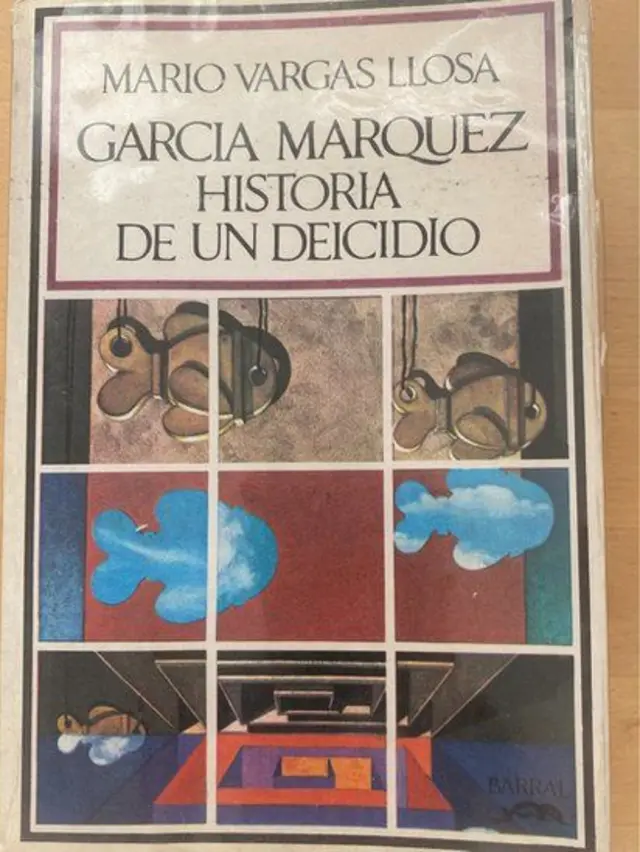

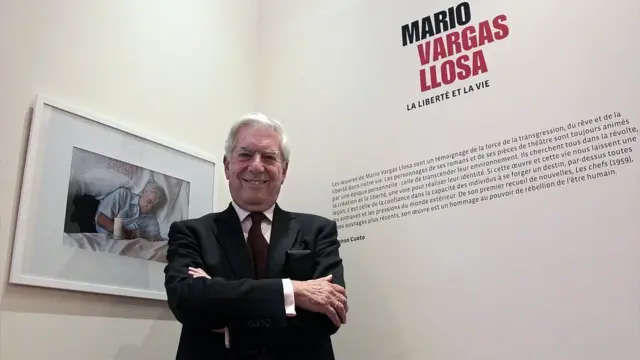

Em 1970, após dois anos de trabalho, ele concluiu seu livro García Márquez: História de um deicídio, o primeiro grande texto (e talvez o melhor) escrito sobre a obra do escritor colombiano (que, ao mesmo tempo, serviu como tese para um doutorado que ele não havia terminado na Espanha).

Crédito, Getty Images

Muitos ficaram surpresos com a generosidade entre dois colegas que eram, ao mesmo tempo, concorrentes.

Em seu livro Historia personal del Boom (“História pessoal do Boom“, em tradução livre), o escritor chileno José Donoso relembra o que um crítico italiano disse a ele sobre o assunto:

“Na Itália, seria impossível para um escritor como Vargas Llosa escrever um livro sobre a obra de outro escritor como García Márquez. E que os dois estivessem na mesma reunião sem que um deles colocasse veneno no café do outro — bem, isso pareceria ficção científica.”

Carmen Balcells os definiu de forma imbatível: “Vargas Llosa é o primeiro aluno da turma, e García Márquez é um gênio”.

“Basta olhar para eles. Qualquer pessoa que os conheça sabe do que estou falando. Mario é um intelectual, alguém com uma cabeça muito bem estruturada, que acumula conhecimentos eruditos sobre vários assuntos e, ao mesmo tempo, é capaz de criar grandes obras. Seu discurso intelectual é de grande estatura, é o primeiro aluno da turma, com louvor.”

“Em contrapartida, Gabo é um gênio no sentido de que é um monstro criativo, uma força da natureza, alguém tocado pela mão de Deus, que tem um dom, e não se dedica a elaborar teorias ou análises sobre a cultura. Me parece algo que os descreve sem valorizar um em detrimento do outro. Sou apaixonada por ambos.”

Crédito, BBC Mundo

No mesmo livro, Donoso data o fim desse fenômeno literário como um projeto compartilhado na véspera do Ano Novo de 1970, “em uma festa na casa de Luis Goytisolo, em Barcelona”, onde estavam presentes Julio Cortázar, Vargas Llosa, García Márquez, Carmen Balcells e Sergio Pitol.

“Naquela noite, se falou acima de tudo da fundação da revista Libre (…) e como ela seria estruturada, expandindo a lista restrita de diretores com a qual começou, até se decidir por diretores rotativos e uma longa lista de membros contribuintes.”

Queda livre

E foi justamente com a primeira edição da revista Libre que começou uma profunda ruptura entre alguns intelectuais ocidentais e Cuba.

Incentivados pelo espanhol Juan Goytisolo e apoiados financeiramente por uma rica herdeira franco-boliviana, alguns dos mais renomados escritores latino-americanos se reuniram para editar a novíssima revista de esquerda da capital francesa.

Entre eles, estavam os quatro principais representantes do boom (Vargas Llosa, García Márquez, Julio Cortázar e Carlos Fuentes), além de Octavio Paz, José Donoso, Severo Sarduy, Claribel Alegría, Plinio Apuleyo Mendoza e Jorge Edwards.

A história completa é contada no quarto capítulo do livro En los reinos de Taifa, de Juan Goytisolo: o primeiro número da revista Libre já estava pronto para impressão quando o chamado “caso Padilla” foi apresentado em Cuba.

Heberto Padilla foi um poeta cubano que participou da revolução e ocupou o cargo de representante do Ministério do Comércio Exterior em Praga. No entanto, no fim da década de 1960, ele começou a criticar e zombar abertamente da política cultural do governo Castro.

Em março de 1971, ele foi preso e, pouco depois, foi divulgada uma “confissão” caricata, que lembrava os julgamentos stalinistas, o que deixou muitos escritores estrangeiros amigos da ilha caribenha furiosos.

Liderados por Vargas Llosa e Goytisolo, vários intelectuais e escritores (incluindo Sartre, Cortázar, Susan Sontag, Italo Calvino, Simone de Beauvoir, Octavio Paz, Alberto Moravia e Marguerite Duras) enviaram uma carta moderada a Fidel Castro apoiando Padilla antes de sua confissão ser divulgada.

Não foi possível localizar García Márquez, que na época estava na Colômbia, em uma das frequentes viagens que ele fez à região enquanto escrevia O Outono do Patriarca para se reconectar com o ambiente caribenho e poder refleti-lo no livro.

É por isso que, depois de procurá-lo em vão, Plinio Apuleyo Mendoza, editor-chefe da revista, deu permissão para colocar o nome do amigo sem consultá-lo, certo de que ele concordaria.

Mas não foi este o caso: uma carta de Barranquilla, na qual Gabo explicava que não queria assinar nada “até ter informações completas sobre o assunto”, havia sido extraviada pelos correios. (2)

Fidel Castro ficou furioso com a primeira carta dos escritores, e fez um duro discurso contra os signatários, “intelectuais burgueses, panfletários e agentes da CIA (…) os pseudoesquerdistas sem vergonha que querem ganhar louros vivendo em Paris, Londres, Roma”. Também proibiu todos os signatários de entrar em Cuba “por um período de tempo indefinido e infinito”

Quase simultaneamente, a “confissão” de Padilla foi divulgada.

Mario Vargas Llosa convocou então uma reunião de emergência em sua casa em Barcelona, onde uma segunda carta, muito mais incisiva e contundente, foi redigida.

Gabriel García Márquez e Julio Cortázar se recusaram a assiná-la.

Crédito, BBC News Mundo

A primeira edição da revista Libre foi adiada para o outono para que pudesse incluir um dossiê completo sobre o caso Padilla, com todos os pontos de vista, incluindo o discurso de Castro, as duas cartas dos intelectuais e a “confissão” do poeta, além de mensagens a favor e contra de escritores e artistas latino-americanos.

A revista também publicou um poema de Cortázar, no qual ele se distanciava completamente das críticas ao governo cubano (antes, ele o bajulava), e uma entrevista com García Márquez que, de acordo com Juan Goytisolo, foi “um prodigioso exercício de acrobacia cuja virtuosidade inspira admiração, se não respeito”, na qual ele conseguiu não criticar os intelectuais signatários, e não romper com o regime cubano.

A revista, que acabou pela falta de dinheiro e por divisões internas, só conseguiu publicar quatro edições.

Um soco no Palácio de Belas Artes

Quem melhor contou a história do fim da amizade entre Vargas Llosa e García Márquez foi Xavi Ayén em seu livro Aquellos años del Boom (“Aqueles anos do Boom“, em tradução livre).

Na obra, ele deixa claro que a amizade não terminou por causa do “caso Padilla”, pois ambos os escritores continuaram morando e se vendo em Barcelona. No entanto, estava claro que algo havia se rompido.

Em seu livro Vargas Llosa, el vicio de escribir (“Vargas Llosa, o vício de escrever”, em tradução livre), de 1991, JJ Armas Marcelo relembra uma tarde de 1973 em Barcelona, quando o peruano o apresentou ao colombiano, que chegou ao encontro vestindo o macacão azul de operário que usava enquanto trabalhava no que viria a ser O Outono do Patriarca:

“Naquela mesma reunião, notei que MVLL estava falando pouco. Olhava para García Márquez com um certo distanciamento, e cheguei a uma conclusão, talvez preconceituosa na época: o romancista peruano não gostava de muitas das ‘saídas’, mais ou menos fáceis, que o colombiano demonstrava em público. ‘Agora vou ao cinema’, disse García Márquez ao se despedir. ‘Vestido assim’, perguntei a ele de forma um pouco provocativa. ‘É claro’, ele respondeu, ‘é para assustar a burguesia’. E MVLL olhou para ele novamente com desdém.”

Crédito, Getty Images

Em seu livro, Ayén deixa claro que o motivo do rompimento definitivo não foi político — mas, sim, algo muito mais banal e humano.

Resumindo: em meados de 1974, quando voltaram a viver no Peru, Vargas Llosa se apaixonou por outra mulher, e deixou Patricia e os filhos.

Em maio de 1975, Patricia Llosa viajou para Barcelona, onde foi recebida pela família García Márquez. A partir daí surgiu a versão de que (talvez em tom de brincadeira) Gabo teria se insinuado para ela.

Pouco tempo depois, os Llosa voltaram a viver juntos.

Isso é explicado em mais detalhes no livro de Ayén, que me disse que, antes de sua publicação, ele havia enviado o texto tanto para García Márquez quanto para Vargas Llosa e suas famílias para que dissessem a ele se algo que havia escrito não era verdade.

Em 12 de fevereiro de 1976, no Palácio de Belas Artes da Cidade do México, houve a pré-estreia do documentário La Odisea de los Andes, com roteiro de Vargas Llosa, sobre o time de rugby uruguaio que sobreviveu a um acidente de avião por 72 dias na Cordilheira dos Andes, em alguns casos recorrendo ao canibalismo.

Segundo Xavi Ayén, a “nata da intelectualidade mexicana” estava no saguão do belo edifício, incluindo a família García Márquez com alguns amigos.

“‘Com licença, vou cumprimentar o Mario’, disse ele antes de entrar na sala de projeção. Lá, ele se dirigiu ao peruano e levou um soco muito forte: ‘Isso é pelo que você fez com a Patrícia em Barcelona’, deixou claro o agressor.”

Na biografia Gabriel García Márquez: Uma Vida, Gerald Martin escreve: “É evidente que Mario chegou à conclusão de que García Márquez havia colocado sua preocupação com Patrícia acima da amizade que os unia. Somente García Márquez e Patricia Llosa sabem o que aconteceu.”

Os anos seguintes

Nos anos que se seguiram, ambos se recusaram a falar sobre o que aconteceu, e Vargas Llosa disse que deixava o assunto para “os historiadores”.

Até onde se sabe, eles nunca mais voltaram a se falar em particular e, em público, houve alguns poucos comentários e impropérios, especialmente por parte de Vargas Llosa, sobre a posição política de García Márquez em relação a Cuba e sua amizade com Fidel Castro.

Crédito, Getty Images

O escritor peruano proibiu a reedição do estudo História de um deicídio (que teve duas edições em 1971), que se tornou um objeto de culto entre os amantes da literatura latino-americana.

O livro só voltaria a ser impresso em 2006, por ocasião da publicação das obras completas do peruano, e como parte de seus volumes de ensaios. Como obra individual, só foi reeditada em 2021, cinquenta anos após sua publicação.

Em uma das últimas vezes em que falou em público sobre García Márquez, no verão de 2017, durante um curso na Universidade Complutense de Madrid sobre a obra do colombiano, quando perguntado se haviam se visto novamente após o afastamento, Vargas Llosa respondeu com uma risada:

“Não… Estamos entrando em um território perigoso, acho que chegou a hora de encerrar esta conversa.” (3)

No entanto, aparentemente houve uma tentativa de reconciliação intermediada por amigos de ambos, quando os dois escritores estavam em Cartagena para o Hay Festival — mas, àquela altura, Gabo já estava sofrendo com a perda de memória.

A história, quem sabe, vai se encarregar de reconciliá-los.

(1) Citado no livro De Gabo a Mario, de Ángel Esteban e Ana Gallego, editora Espasa, 2009. As cartas estão na Universidade de Princeton. A carta também foi incluída no livro Las cartas del Boom, publicado em 2023 pela Alfaguara. De acordo com o livro, a última carta trocada foi em março de 1971, enviada por García Márquez a Vargas Llosa de Barranquilla, na Colômbia.

(2) Citado no livro Gabo, cartas y recuerdos, de Plinio Apuleyo Mendoza, Ediciones B, 2013.

(3) Na peça Al pie del Támesis, publicada por Vargas Llosa em 2008, um dos personagens relembra que, 35 anos antes, deu um soco no melhor amigo (“um soco de boxeador”), que acabou com a amizade deles.