- Despite an uptick in revenue, the protocol’s network activity dropped

- Selling pressure on the token has been rising, hinting at a price correction

Since the beginning of the year, AAVE has demonstrated promising performances in terms of capitalized value. To be precise, the protocol’s revenue skyrocketed.

In fact, the protocol’s token, AAVE, also recorded a similar performance last year.

A dive into AAVE’s network activity

Milk Road, a popular crypto analyst, recently shared a tweet revealing an interesting development. According to the same, AAVE, since the beginning of this year, has amassed a revenue of $500 million.

Thanks to the same, AAVE’s generated revenue is the highest among other top protocols right now. AAVE’s revenue is followed by Venus Protocol and Compound.

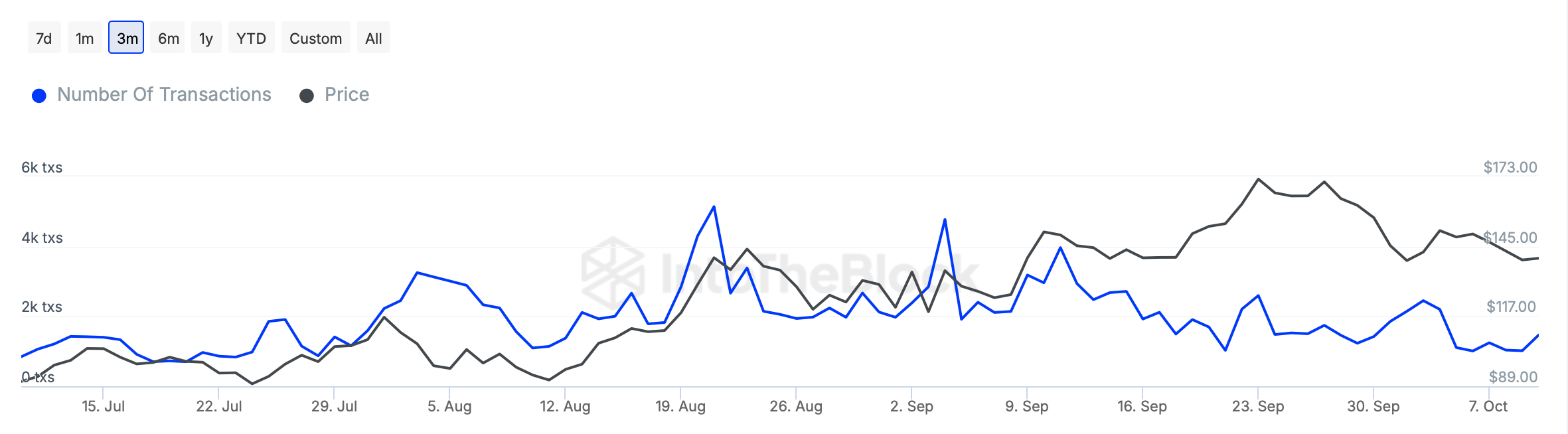

However, despite the massive hike in revenue, its network activity dropped, as per AMBCrypto’s analysis of IntoTheBlock’s data. For instance, AAVE’s daily active addresses, after spiking in September, started to decline slightly. A similar decline was also noted in terms of transactions, which can be attributed to the drop in active addresses.

Source: IntoTheBlock

Similarly, the protocol’s addresses birth-to-death ratio also declined. Here, this alludes to the ratio of new addresses being created to addresses with a balance that have not made a transaction in over one year.

What about the token’s price action?

After checking the protocol’s network activity, AMBCrypto planned to assess the token’s performance on the price front. We found that the token’s price had risen by more than 100% in the last year. However, the last few months or weeks were less volatile and didn’t allow investors to earn much profit.

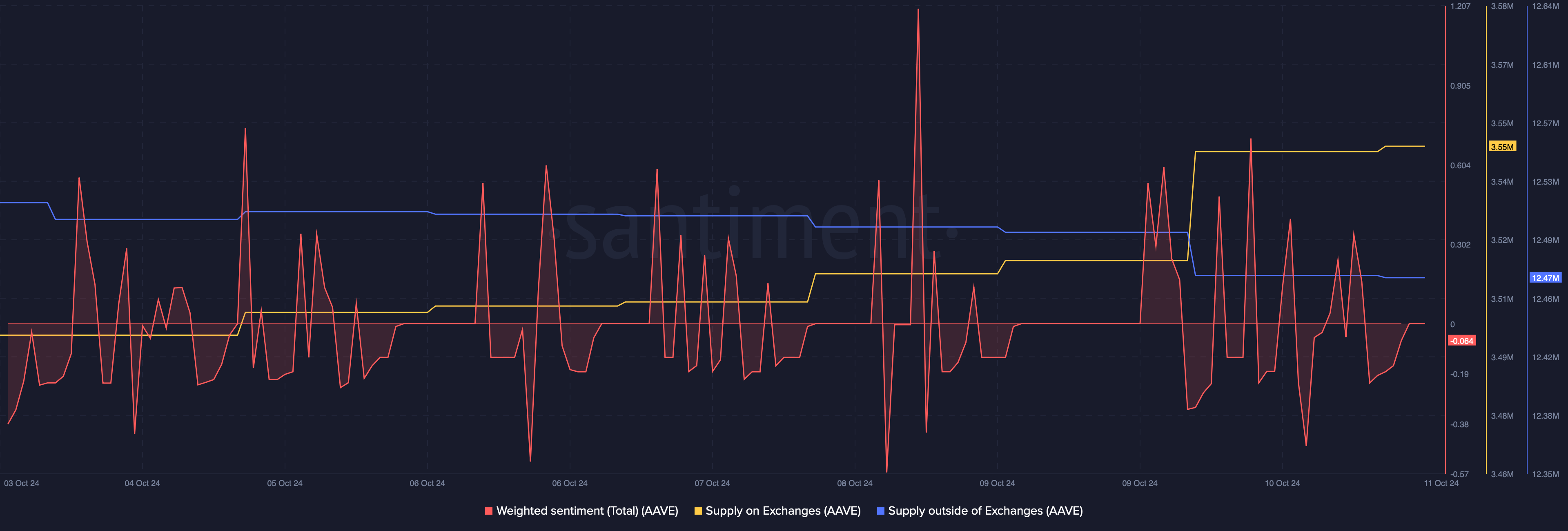

Therefore, we analyzed AAVE’s on-chain data to better understand whether things could change in Q4. As per our analysis, market sentiment around the token has been turning bearish, as evidenced by the decline in AAVE’s weighted sentiment.

The drop in positive sentiment was also proven by the hike in selling pressure.

As per Santiment’s data, AAVE’s supply on exchanges increased sharply. Meanwhile, its supply outside of exchanges dropped, indicating that investors have been actively selling the token. Generally, an uptick in sell pressure causes price corrections.

Source: Santiment

Read Aave’s [AAVE] Price Prediction 2024–2025

However, the good news was that a look at AAVE’s daily chart revealed that it successfully tested a crucial support near $135. This indicated that there were chances of a bullish trend reversal.

If that happens, then bulls might push the token to $170 again. However, in case the bears dominate in the coming days, then it won’t be surprising to see AAVE plummeting to $118.

Source: TradingView