Bitcoin finally managed to jump above its possible market bottom.

Though buying pressure was high, a few indicators turned bearish.

After a week of price increases, Bitcoin [BTC] has once again turned bearish in the last 24 hours. However, this trend might change in the coming days as BTC was following a historical trend. If history repeats itself, then investors might soon witness a major price movement.

Bitcoin’s key indicator flashes

AMBCrypto reported earlier that Bitcoin managed to cross $64k a few days ago, but the move didn’t last. The king coin witnessed a nearly 2% price correction in the last 24 hours, pushing it down back to $63,117.53.

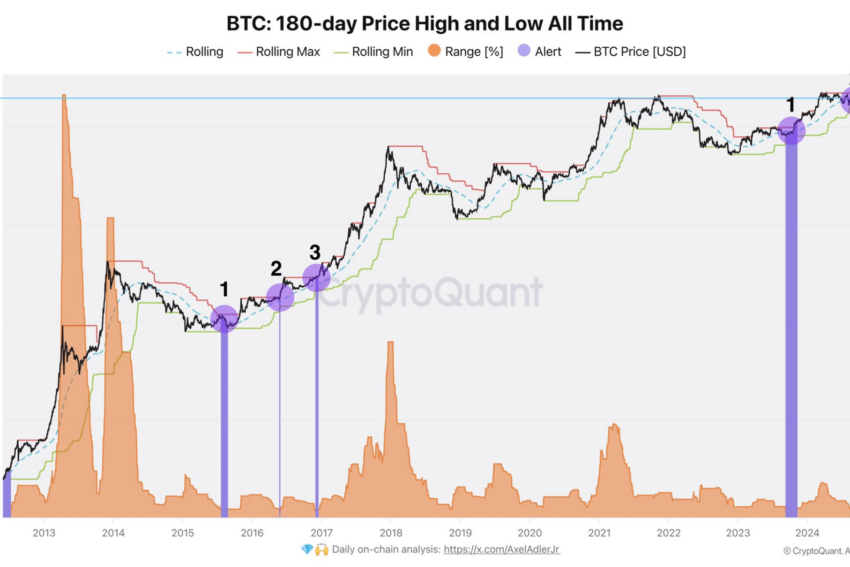

While that happened, Axel, a popular crypto analyst, posted a tweet revealing an interesting development. As per the tweet, for the past six months, volatility has continued to compress, and an alert has appeared on the chart.

Notably, the alert appeared for the 5th time in Bitcoin’s history.

To be precise, such alerts emerged back in 2015, 2016, 2017, and 2023 before again appearing in 2024. Historically, whenever this alert appeared, BTC’s price registered considerable price movement northwards.

Therefore, if history repeats itself, then investors might expect Bitcoin to begin a fresh bull rally in the coming days.

Source: X

Is BTC ready for a price pump?

Since history indicated a new bull rally, AMBCrypto checked Bitcoin’s on-chain metrics to find whether they also suggested a price hike. Our look at Glassnode’s data revealed that BTC’s price just jumped above its possible market bottom of $61.8k.

If the Pi Cycle Top indicator is to be believed, the upcoming bull rally might as well push the coin towards its possible market top of $109k in the coming weeks or months.

Source: Glassnode

Apart from that, AMBCrypto also reported earlier that buying pressure on the coin was high, which also hinted at a price uptick. However, not everything was in the king coin’s favor.

Our analysis of CryptoQuant’s data revealed that Bitcoin’s aSORP turned red. This clearly meant that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

We then took a look at Bitcoin’s daily chart to better understand the likelihood of a bull rally. As per our analysis, BTC was getting rejected at its resistance of $64.1k.

Additionally, the coin’s price had also touched the upper limit of the Bollinger Bands, which hinted at a price correction.

Source: TradingView

Read Bitcoin (BTC) Price Prediction 2024-25

If a price correction happens, then BTC might again drop to $62k. But, in case of a bull rally, it will be crucial for BTC to go above the $64k-$65k range, and liquidation will rise sharply there.

Usually, a hike in liquidation results in short-term price corrections.

Source: Hyblock Capital

Previous: SAB 121 under fire: Bipartisan push to rescind controversial bulletin

Next: Will Toncoin bulls reclaim their edge after this rally?